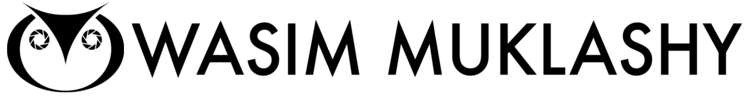

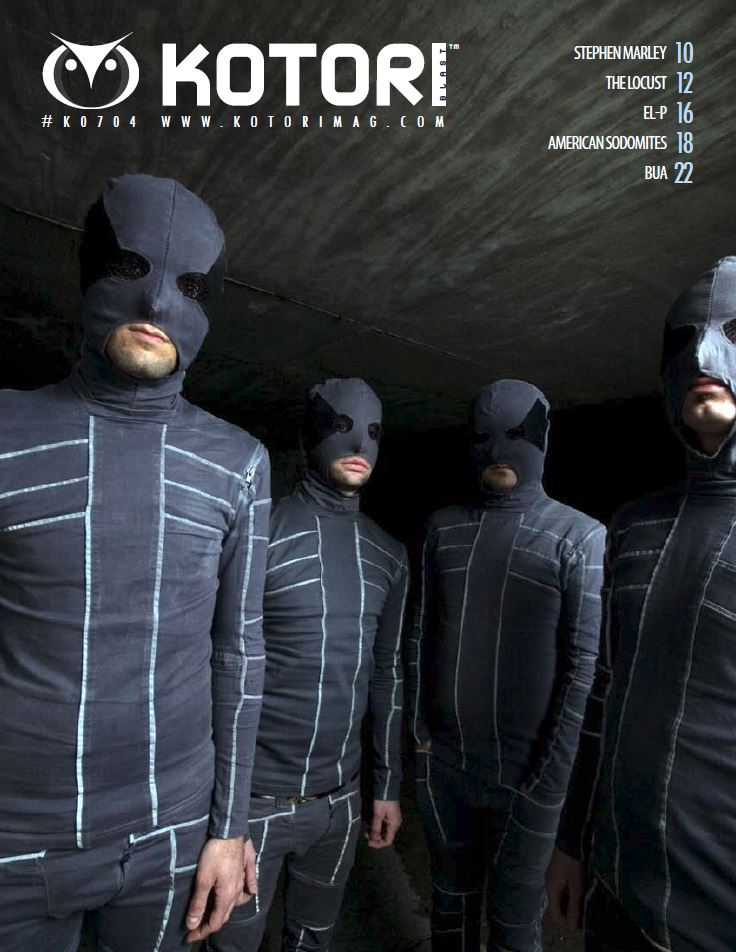

I once had a magazine. It was all about music art politics and culture. It was rad. It started as WAV Magazine, but then we almost got sued by Clear Channel, so changed it to Kotori Magazine (with the blessing of a Hopi Indian chief as ‘kotori’ is one of their sacred kachinas).

Well that magazine no longer exists.

And at the time, neither did smartphones.

Yes, I’m old.

But I would not let those magazines die.

So here are pdfs.

Scroll through the buggers and you’ll find interviews and features with everyone from the Ozomatli NOFX and System of a Down to Ralph Steadman and Noam Chomsky. Those were interesting days…

The following issues were all published after we stopped print. These were audio & video enhanced PDFs - before the iPads and iPhones. Yes, we were fucking geniuses and way ahead of our times. No doubt.